Table of Contents

- Australia's top income tax rate is comparatively the highest in the ...

- Tax Brackets Australia 2024-2025 | Pherrus Financial

- Population overview | Australian Taxation Office

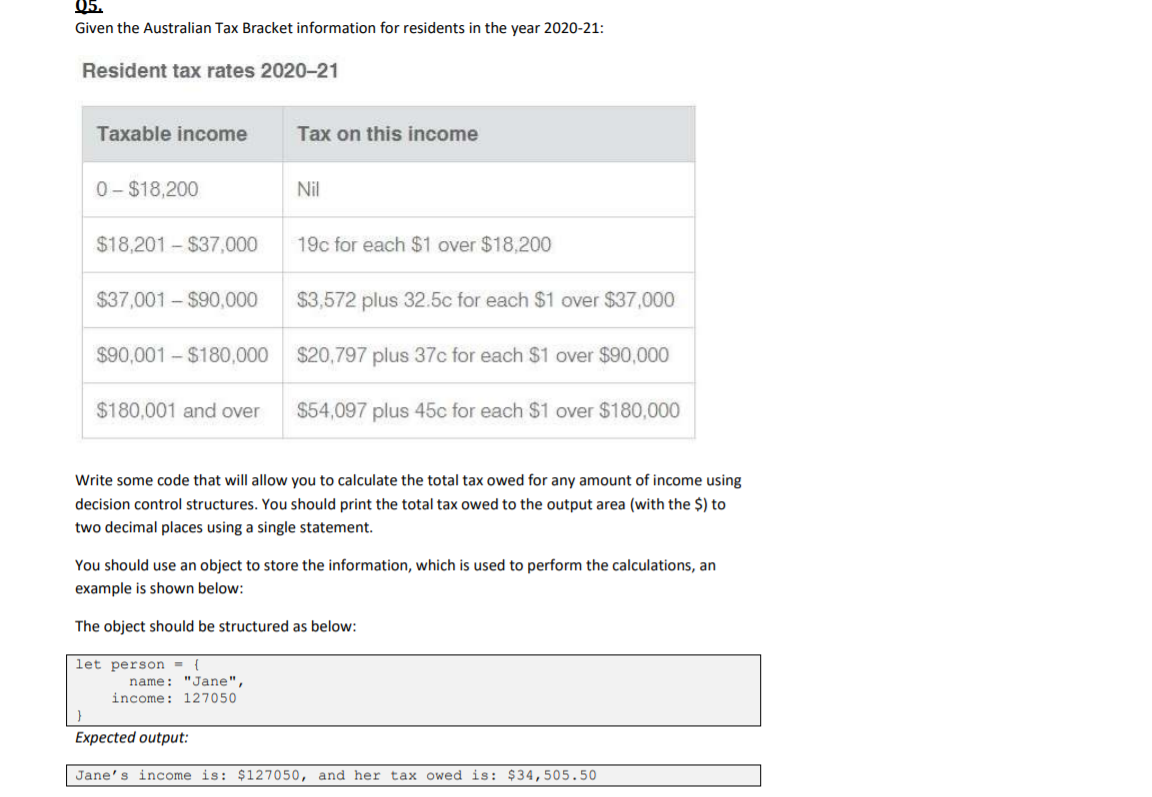

- Solved 05. Given the Australian Tax Bracket information for | Chegg.com

- Stage three tax cuts: Bracket creep will put 1m Aussies into top tax ...

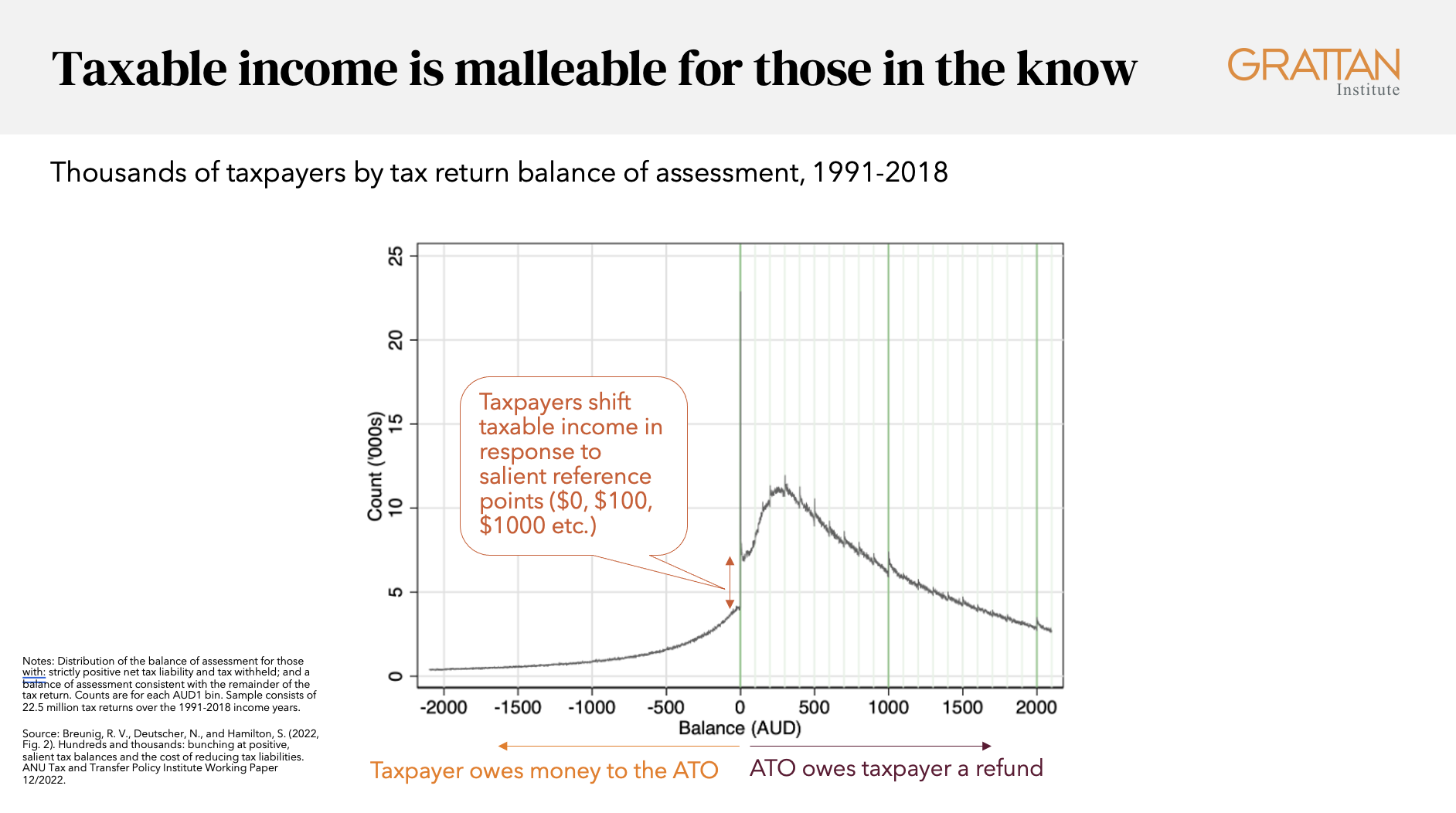

- Tax reform in Australia: an impossible dream? - Grattan Institute

- Believe it or not...1 in 3 Australian households has net wealth of more ...

- How to maximise tax return for FY25 | news.com.au — Australia’s leading ...

- Australia’s tax rates: Top earners shoulder more of the tax burden

- Australia’s tax rates: Top earners shoulder more of the tax burden

What are Tax Tables?

2025 Tax Tables: What's Changing?

2025 Tax Rates and Thresholds

Here are the expected tax rates and thresholds for the 2024-2025 financial year: | Taxable Income | Tax Rate | | --- | --- | | $0 - $18,201 | 0% | | $18,201 - $45,000 | 19% | | $45,001 - $120,000 | 32.5% | | $120,001 - $180,000 | 37% | | $180,001 and over | 45% |

How Will the 2025 Tax Tables Affect You?

The changes to the 2025 tax tables will affect individuals and businesses in different ways. If you're a low- or middle-income earner, you may be eligible for a higher LMITO, which could result in a larger tax refund. On the other hand, if you're a high-income earner, you may be subject to a higher tax rate. For businesses, the changes to the tax tables may impact your cash flow and tax planning strategies. It's essential to consult with a tax professional to ensure you're taking advantage of all the available tax deductions and offsets. The 2025 tax tables for Australia will bring some significant changes, and it's crucial to stay informed to ensure you're meeting your tax obligations and taking advantage of all the available tax savings. By understanding the updates to the tax brackets, tax rates, and thresholds, you can better plan your finances and make informed decisions about your tax strategy. Remember to consult with a tax professional or the ATO website for the most up-to-date information on the 2025 tax tables and how they may affect you. By being proactive and staying informed, you can navigate the complexities of the Australian tax system and ensure a smooth and successful financial year.For more information on the 2025 tax tables and other tax-related topics, visit the Australian Taxation Office website or consult with a qualified tax professional.